Customer Care: 866.625.8532 Sales Inquiries: 503.419.3544

KLAS Research Awards CarePayment Top Patient Financing Company for 2023 - Read Press Release

Blog | March 21, 2024

Recourse vs. Nonrecourse Financing: What’s Best for Patients?

What exactly do recourse and nonrecourse financing mean? Both providers and patients often find themselves grappling with the intricacies of various payment options and the two terms that frequently emerge are recourse vs. nonrecourse financing.

But what do these terms truly entail for patients, and why is it crucial to understand their implications? It is important for decision-makers to understand the intricacies of these financing models to understand their impact on patient well-being and have the knowledge needed to advocate for the most equitable solution.

In this post, we’ll cover:

- What is Recourse Financing?

- What is Nonrecourse Financing?

- Recourse vs. Nonrecourse Financing Liabilities

- Interest-Free vs. Interest-Bearing Solutions

- Why Health Systems Should Pick a Recourse Lending Solution

What is Recourse Financing?

Many providers don’t think that they want recourse financing. In this model, a hospital partners with a patient financing company and sends their patient balances to the partner to manage and collect payment. Should a patient fail to pay, the debt is returned to the healthcare provider. Providers share the risk with the patient financing company of patients not paying their bills. However, the outcomes of recourse financing are not always as they seem.

Recourse financing offers patients a lifeline when facing medical expenses. For most patient financing models, recourse is what allows patients to have 0.00% APR financing. Zero percent patient financing offers relief to patients during challenging times and ensures that patients are treated equally and inclusively. Moreover, recourse financing empowers healthcare providers to maintain control over the patient experience. It allows them to retain stake and visibility into patient care, fostering trust and confidence among patients.

What is Nonrecourse Financing?

Nonrecourse financing presents a different scenario for patients. When a patient account becomes delinquent under this model, it remains with the patient financing vendor. Unfortunately, this often necessitates interest charges or deferred interest, exacerbating patients’ financial burdens. Unlike recourse financing, nonrecourse models place the burden solely on the financing vendor, resulting in fewer patients qualifying and disparate repayment terms based on their financial circumstances. This lack of inclusivity and patient-centricity has raised concerns among regulatory bodies and advocacy groups.

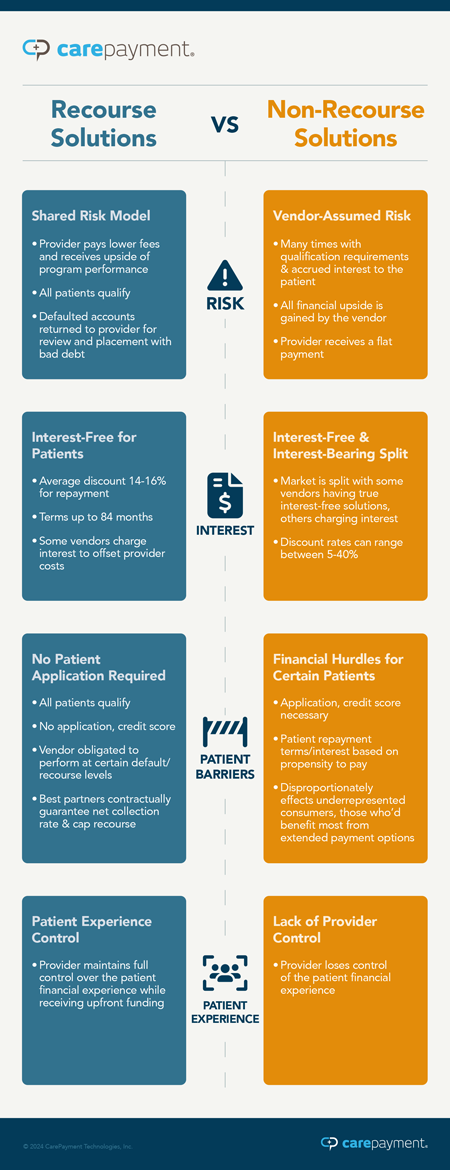

Recourse vs. Nonrecourse Financing Liabilities

When considering the options, there exist both recourse and nonrecourse liabilities. Analyzing the dynamics between nonrecourse and recourse financing offers insight into their respective impacts on patients.

Recourse:

- Shared risk with provider means that patient account balances can be returned to provider if the patient does not pay. This means that providers do not completely wash their hands of a patient’s financial obligations, even after transferring the account to a financing vendor.

- In cases where a significant portion of patients default on their payment obligations, providers may experience financial strain or reduced profitability.

Nonrecourse:

- The limited patient qualification required for these solutions leads to disparities in repayment terms and interest rates.

- Regulatory scrutiny has highlighted the disproportionate impact of nonrecourse financing on underrepresented consumers, particularly when it comes to interest rates.

- Providers relinquish control over the patient experience, potentially compromising the quality of care provided to their patients financial matters.

- All financial upside is gained by the patient financing company, leaving providers with a fixed payment amount and diminished influence over patient outcomes and satisfaction.

- In the worst cases, patient financing vendors who purport to be non-recourse options can actually charge patients deferred interest or even recourse their accounts.

As demonstrated by these liabilities, when examining recourse and nonrecourse liabilities, the outcomes for patients are the most crucial decision points that should be considered.

Interest-Free vs. Interest-Bearing Solutions

As has been established, the choice between nonrecourse financing vs. recourse financing is often really a choice between charging patients interest or not. A CarePayment member survey found that ZERO percent of patients prefer a traditional, interest-bearing solution.

The adoption of interest-bearing patient payment plans reflects a concerning trend in healthcare financing, one that directly impacts the financial stability and well-being of patients. The introduction of interest rates, particularly at excessive levels, worsens the already significant burden of medical debt for individuals seeking treatment. Patients, already grappling with the costs of healthcare services, now face additional financial strain due to accruing interest, potentially leading to long-term financial hardship and even bankruptcy.

Some patients have reported not being aware of interest being charged on their medical bills, leading to being sued and liens being put on their assets, all without their knowledge. As these high-interest loans become increasingly prevalent, it’s imperative to recognize the detrimental effects they have on patients’ ability to afford essential medical care, highlighting the urgent need for reform in healthcare financing practices to prioritize patient well-being.

The choice between interest-free and interest-bearing solutions carries significant implications for patients. Interest-free financing plays a crucial role in increasing patient engagement and financial return by broadening access to healthcare services. When patients are offered interest-free financing options, they are more likely to fulfill their financial obligations, leading to reduced payment delinquency and enhanced provider revenue streams.

Moreover, interest-free solutions contribute to higher levels of patient satisfaction and loyalty, fostering stronger relationships between patients and providers. By prioritizing interest-free financing, healthcare providers mitigate compliance risks and ensure adherence to regulatory standards, safeguarding patient rights and provider reputation. Overall, interest-free financing emerges as a patient-centric solution that aligns with the principles of compassionate healthcare practices.

Why Health Systems Should Pick a Recourse Lending Solution

Healthcare providers play a pivotal role in shaping patients’ financial experiences. Opting for an only nonrecourse patient financing solution that charges patients interest can be detrimental both to patient well-being and a hospital’s reputation. For example, UNC Health previously had a longstanding practice of not charging interest on patient payment plans. It took a different path when it partnered with a patient financing company in 2019 that implemented interest charges for some patients. The consequence of this decision was evident as patients experienced increased financial strain, leading to heightened scrutiny of the hospital’s patient care practices and financial policies.

Most notably, when deciding between recourse vs. nonrecourse financing, opting for recourse lending solutions demonstrates a commitment to patient-centric care:

- Recourse financing models prioritize patients’ financial well-being, offering relief from the burden of interest charges, especially deferred interest.

- Providers retain control over the patient experience, ensuring that care remains the focal point of every interaction.

- By partnering with organizations like CarePayment, healthcare systems can offer recourse lending solutions that align with their commitment to equitable and compassionate care.

- Together, providers and financing partners can empower patients to access the care they need without the fear of financial instability, fostering healthier communities and stronger healthcare ecosystems.

At CarePayment, we are dedicated to championing patient-centric financing solutions that prioritize affordability and accessibility. In both our recourse and nonrecourse models, we firmly reject the notion that patients should suffer financial burdens or be subject to interest charges, which is why we have never charged a patient interest.

In conclusion, understanding the nuances between recourse and nonrecourse financing is paramount in ensuring equitable and compassionate patient care. We invite you to further explore these concepts by filling out the intent form below, to learn more and to receive more ongoing dialogue surrounding patient-centric healthcare financing solutions.