Customer Care: 866.625.8532 Sales Inquiries: 503.419.3544

CarePayment Named Top Performer in Patient Financing and Financial Engagement Solutions by Black Book Research - Read Press Release

Blog | June 2, 2022

The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Guest blog by Jane Sarasohn-Kahn, MA, MHSA. Jane is a health economist, advisor, and thought leader to organizations focused on the intersection of health, technology, and people. Jane founded THINK-Health after working with health care consultancies in the US and Europe. Jane’s clients span the health/care ecosystem: technology, pharma, and life sciences, providers, plans, retail, financial services, and consumer goods. Jane earned an MA (Economics) and MHSA (Health Planning) from the University of Michigan and published recent books, Health Citizenship: How a virus opened hearts and minds (2020) and HealthConsuming™: From Health Consumers to Health Citizens (2019).

Guest blog by Jane Sarasohn-Kahn, MA, MHSA. Jane is a health economist, advisor, and thought leader to organizations focused on the intersection of health, technology, and people. Jane founded THINK-Health after working with health care consultancies in the US and Europe. Jane’s clients span the health/care ecosystem: technology, pharma, and life sciences, providers, plans, retail, financial services, and consumer goods. Jane earned an MA (Economics) and MHSA (Health Planning) from the University of Michigan and published recent books, Health Citizenship: How a virus opened hearts and minds (2020) and HealthConsuming™: From Health Consumers to Health Citizens (2019).

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Add on top of these significant stressors the need to deal with medical bills, which is another source of stress for millions of patients in America.

I appreciated the opportunity to share my perspectives on “The Patient As the Payer: How the Pandemic, Inflation, and Anxiety are Reshaping Consumers” in a webinar hosted by CarePayment on 25 May 2022. In this post, I summarize some of the key issues we covered.

We know the pandemic experience re-shaped consumers’ lives for work and play, school and fitness, and food and safety perspectives. By working from home and having to stay in place for weeks, months, and for some, over a year and a half or longer, consumers took on more do-it-yourself m, DIY, workflows, and life-flows.

These self-care tasks extended in our health care across all dimensions of “health” including mental health, nutrition, gut wellness, sleep, and certainly financial health. And that is part of the patient-as-payer’s workflow.

One of the toxic side effects of the pandemic for many people was a hit on household finances. Some people could not work from home due to the nature of their jobs requiring up-close-and-personal human touch; other workers lacked households with broadband or WiFi connectivity, limiting their ability to do work tasks that could have been remotely accomplished.

As a result, more people in the U.S. told the Gallup Poll in April 2022 that their financial situation has eroded in the past year, up to 1 in 2 people which is a statistic we haven’t seen since the Great Recession of 2008. Furthermore, the share of income held by the middle class – defined as $52-$156,000 for a family of at least 3 people – has fallen over the last 50 years, while upper-income households’ share has increased.

This is the widening income gap between upper and lower incomes, which was already a reality before the pandemic.

I wrote early on in the pandemic that mental health impacts would be the epidemic inside and beyond the coronavirus itself. And financial stress directly and negatively impacts mental, behavioral, and physical health.

The American Psychological Association study I cited in that post from 2020 found that financial stress was indeed contributing to Americans’ sense of anxiety and depression.

It’s important to note that health care cost fiscal stress is not only a symptom for people lacking health insurance. What is not commonly discussed is that medical bill problems are very common among people who have insurance and not only the uninsured. Well into the second year of the pandemic, one in three people with employer-sponsored health coverage had problems with medical bills and medical debt.

This challenge has grown due to high deductibles and growing out-of-pocket payments for copays and coinsurance.

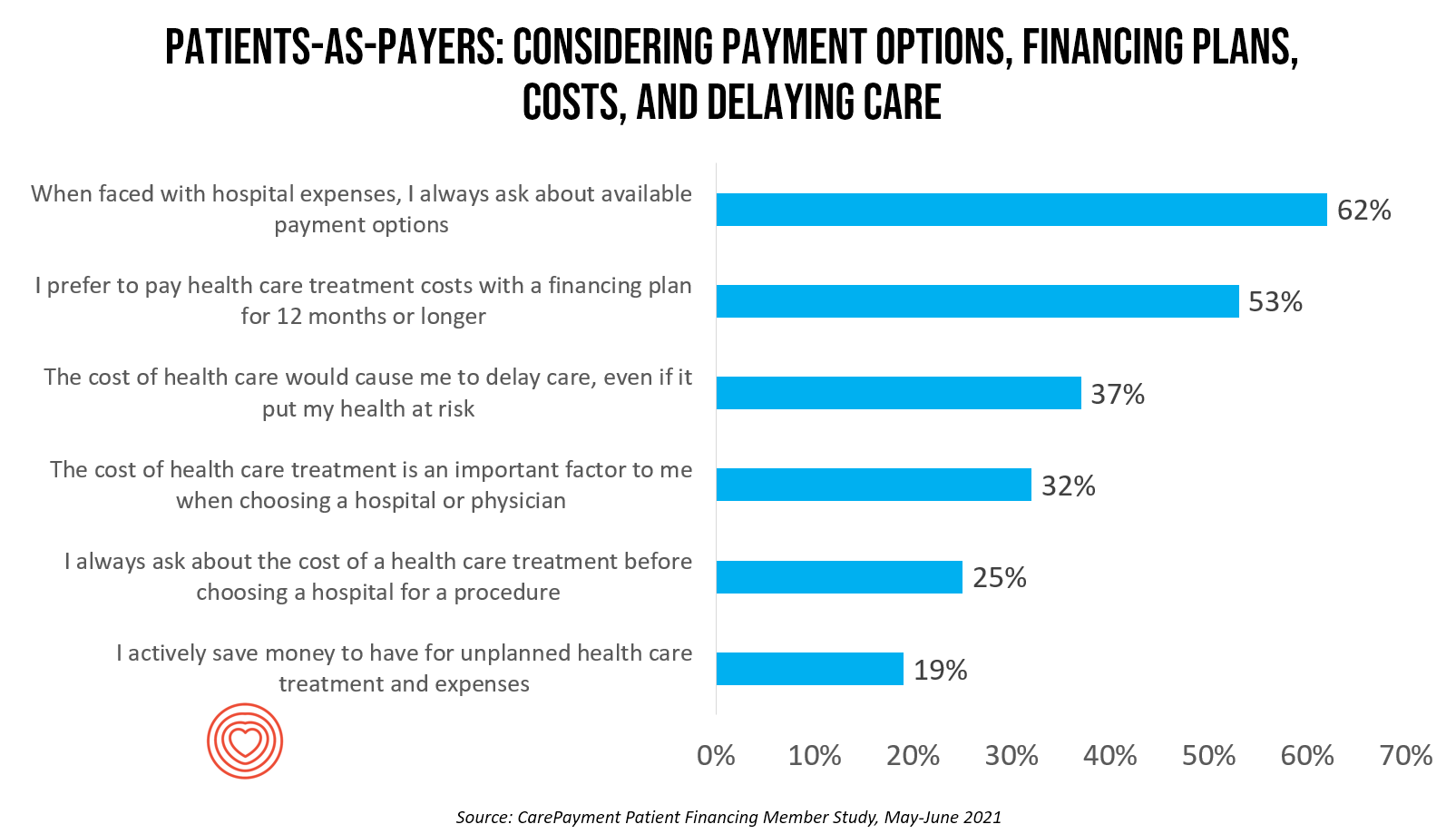

It’s true to say that in the U.S. in 2022, billing and medical payments are now embedded in patients’ experiences, regardless of the type of payor. CarePayment conducted a survey among consumers learning more about patients-as-payers and their demands for more retail-style options for billing and payment processes.

Note from the bar graph that the most common areas that would engender loyalty have to do with service – the quality of customer service, say in a call center or in an office setting; the quality of communication; the provider’s bedside manner; and the ease of registration. Cost, while important, ranked below these service factors in CarePayment’s study.

For bill paying, consumers think health care is the most onerous payment journey compared with other sectors they deal with regularly, like their phone bills or banking or grocery, or retail.

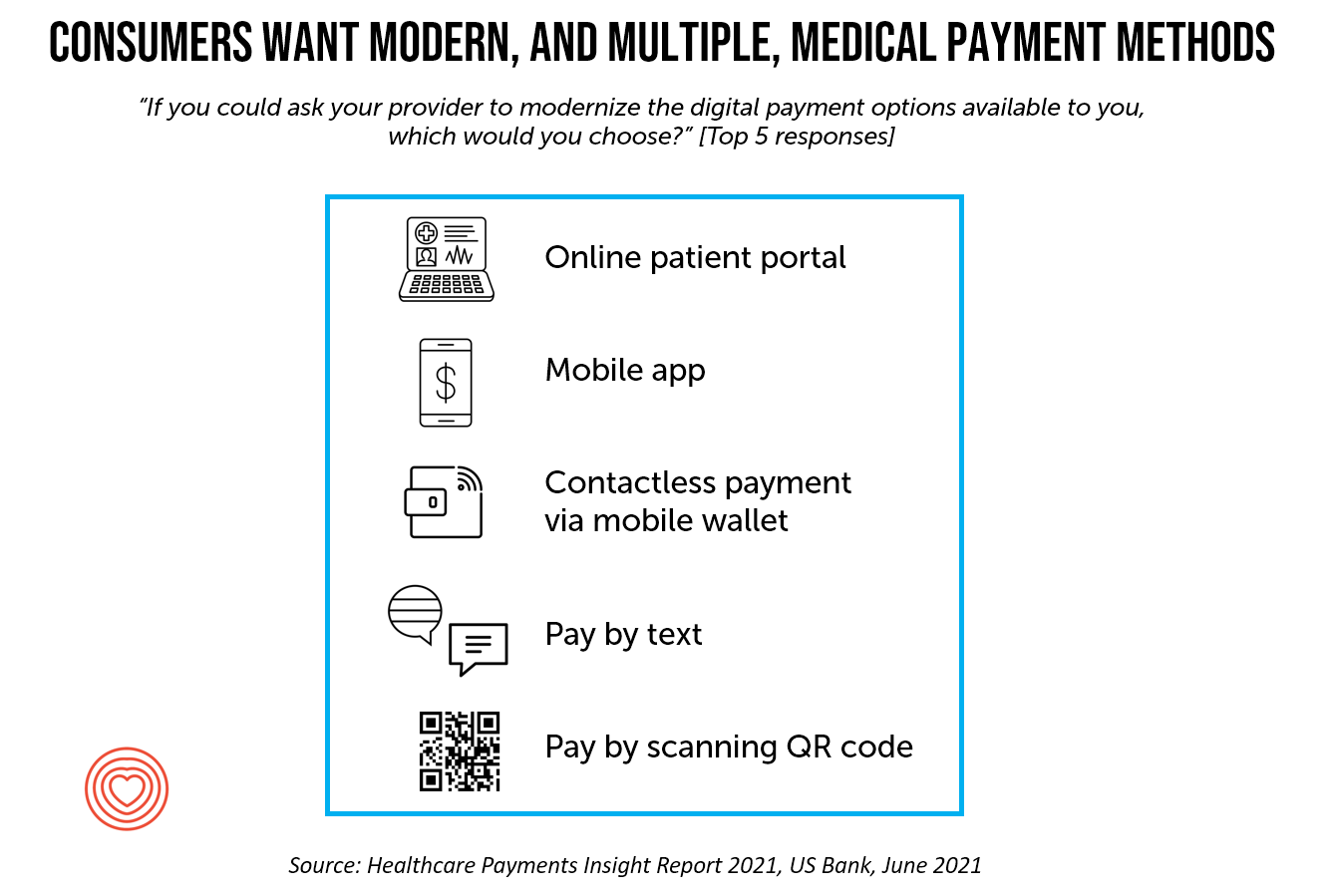

Consumers as medical bill payers want easier ways to pay for medical bills, and more than one size fits most – not just one, but many. These include online patient portals, mobile apps, contactless payment via mobile wallets, paying by text, or paying by QR code scan, which a recent US Bank study learned.

The cost of health care also continues to dissuade over one-third of people from delaying care – even if it could put one’s health at risk, CarePayment found. Of course, skipping health care due to costs when needed is one way to decrease health and well-being.

Another health risk is medical debt. In the current era of consumer price inflation due to soaring food prices, medical debt has now joined the roster of risky determinants of health – socioeconomic factors like education, job security and fair pay, social connections, clean and safe environments, and lifestyle behaviors, such as not smoking tobacco, alcohol in moderation, and physical activity.

Medical debt has become such a financial burden and stress in the U.S. that President Biden’s Administration announced plans to address the problem and enhance consumer protections at the Federal level through the Consumer Financial Protection Bureau and other initiatives.

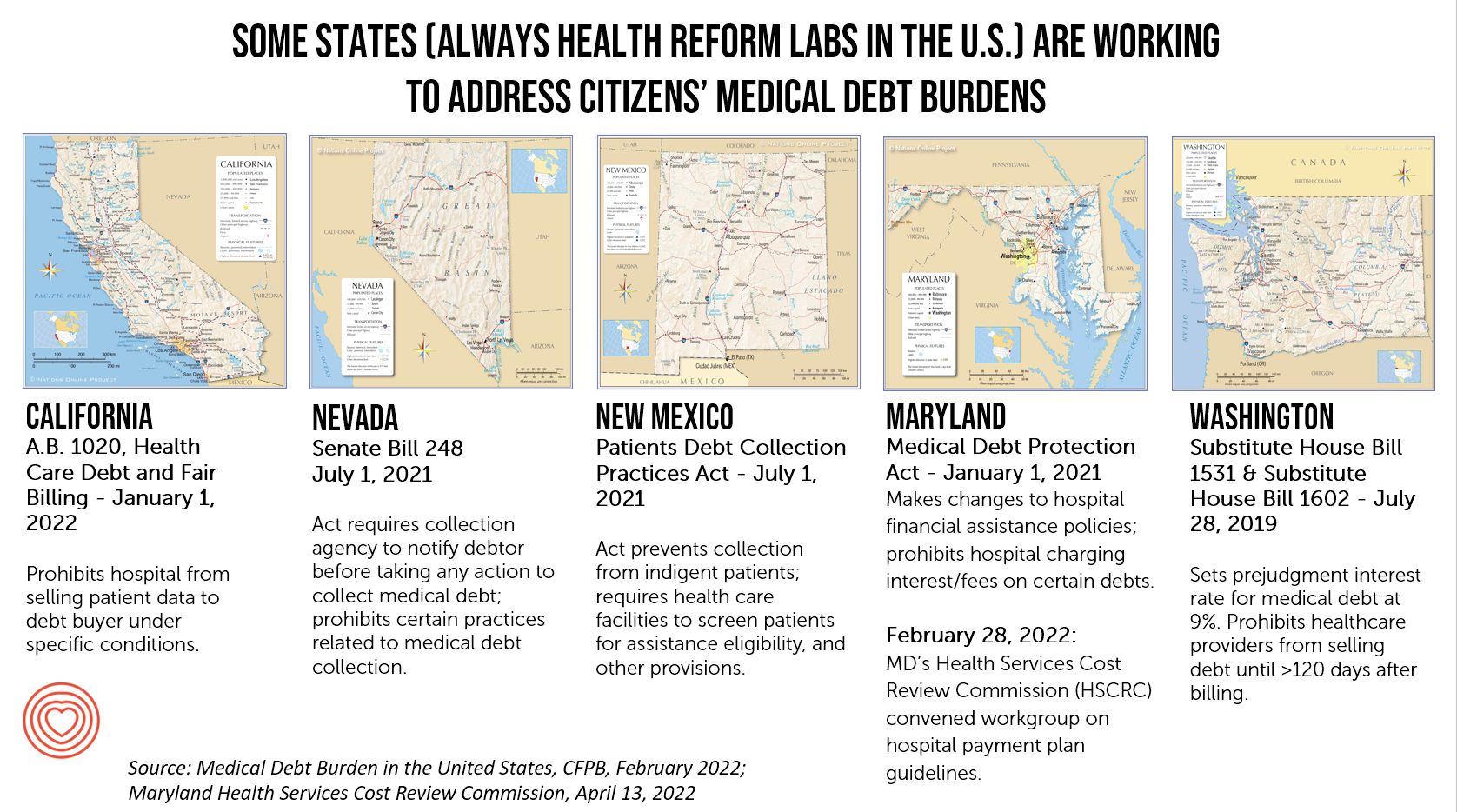

But the real action to watch and act on in the immediate term is at the state level. Those of us in the U.S. who follow health policy wonkily always look to the States and Governors for innovation as labs for health policy innovation. This holds true for medical debt, which I illustrate here in these five state maps.

We can generally look to California for health care innovations in financing and technology, and the same holds true for dealing with medical debt and fair billing. Maryland, too, has long been an innovator in health care payments and pricing, as well as Washington. And here we add in Nevada and New Mexico for novel approaches to medical debt. If you are operating in any of these states, you’ll already be aware of these initiatives. The call to action here is to stay abreast of these developments both nationally and at the state level as Governors often lead in healthcare pioneering efforts that have a real impact on healthcare financing and delivery.

An overall call-to-action here is to understand the patient-as-payer, their sense of value and values, and address financial well-being with a holistic, omni-channel approach.

This requires putting on the hat of a consumer-facing retailer or consumer goods company. In addition, attending to health equity and health literacy in all dimensions will help build greater trust with patients. Doing so can bolster financial wellness for both the person and the health care organization.