Maintain revenue under rapidly changing patient financing legislation.

The changes under the No Surprises Act and other federal and state legislation are causing significant impacts on provider revenue due to losing their out-of-network cash flow, fines, and increased staff employed to meet new requirements. Providers can face a hefty amount of $10,622 in fines for each violation of the federal No Surprises Act. Multiply that fine by each time a Good Faith Estimate was missed, and providers are faced with huge hits to their bottom line.

The changing patient financing landscape is causing hospitals to lose more revenue and makes day-to-day operations that much harder - that's why we help providers collect 70% more of their aged receivables with increased patient financial engagement. With a 2x increase in overall earned revenue collections, we ensure providers get the revenue they need to continue providing high-quality care to the communities they serve.

The industry’s highest financial return.

We capture more earned revenue than any other vendor, regardless of the age of receivable, delivering increased operating margin and guaranteed financial results.

2X

Increase in overall earned revenue collections

70%

Of collected revenue from receivables >60 days old

>$4 Billion

Balances processed

WEBINAR

Navigating the No Surprises Act and Changing Patient Financing Legislation

Get a deep dive into the No Surprises Act, the latest regulatory trends, and federal legislation that are disrupting revenue cycle operations and patient financing strategies

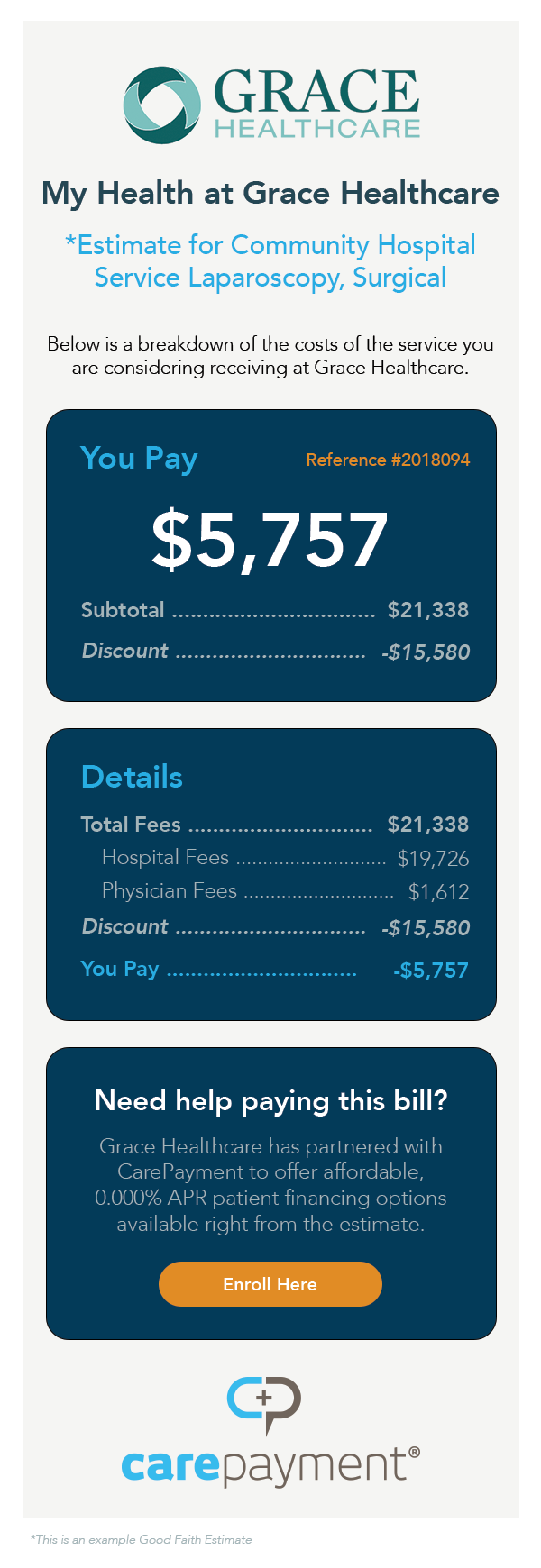

We're there for your patients after their Good Faith Estimate.

The No Surprises Act establishes new federal protections against surprise medical bills. For services covered by the NSA, providers are prohibited from billing patients more than the applicable in-network cost-sharing amount. The federal government estimates the NSA will apply to about 10 million out-of-network surprise medical bills a year.

Patients who are uninsured or will be paying for care without health insurance will receive a “good faith” estimate (GFE) for the cost of care before care is received. Failure to provide a GFE can result in hefty fines of $10,000+ per missed GFE, causing providers to lose money.

CarePayment can help ease some of the burdens that the NSA may cause for providers. Our patient financial engagement platform aids the provider by ensuring the patient can afford their care while providers get paid for their services rendered. Our zero-interest, affordable payment plans are available right from the Good Faith Estimate (GFE) or anytime before care for anyone who needs a long-term payment option through our Pre-Care self-enrollment program. By partnering with CarePayment, providers can financially engage more patients with patient-centered payment plans while also capturing the industry’s highest earned revenue - guaranteed.

See how CarePayment can transform your revenue collection under changing legislation.

Fill out the form and one of our patient financial engagement experts will be in touch shortly.

Knowledge Center

Case studies, white papers, videos and tips to help providers and patients manage their total financial health.

Industry News

Patients have spoken – and they’re tired of interest-bearing patient financing solutions

As the medical debt crisis continues to take its toll on the financial and mental well-being of healthcare consumers across the country, more and more…

Blog

Navigating the No Surprises Act and Changing Patient Financing Legislation: Webinar Recap

On February 8th, Samantha Roberts, CarePayment’s Regulatory Compliance Manager, held a webinar on how to ease the burden of compliance with new legislation like the…